No one knows when real systems change or the tipping points that trigger it will happen. But every individual, team, or organization can get ahead.

This article aims to provide some direction while launching a bigger discussion. I’ve outlined past systemic changes below, positive and negative, and futures where environmental, social, and economic systems change for the better. It includes illustrative examples of organizations that got ahead and are currently ahead (see Table 1 below).

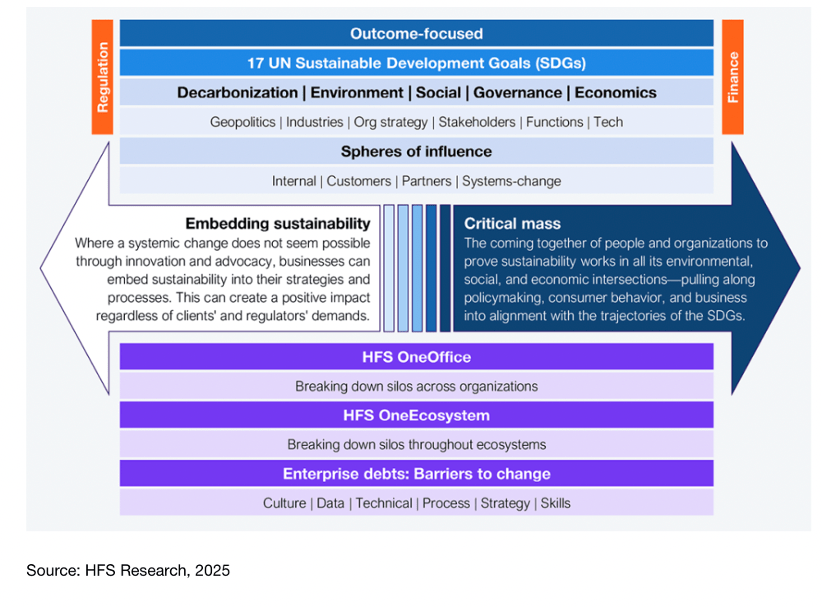

So many views, frameworks, and formal theories exist on systems change and tipping points. HFS Research also now has one based on reaching Critical Mass. But both HFS and me, like most commentators, are in no position to say precisely when future systems will ‘tip,’ whether that’s the exponential (successful or otherwise) adoption of artificial intelligence or a rapid transition to sustainability goals.

But anticipating and being ahead—whether as a trendsetter, early innovator/adopter, or fast follower—will beat frantically reacting to catch up when systems change. Regulators, the public, and other businesses will look to those who pioneered the new system as guides.

Sustainability needs a critical mass that proves unequivocally that the new system works across all metrics: the centerpiece of a view on systems change, where the ‘overstory’ changes regardless of your underlying motivations (see Chart 1).

Past tipping points are well documented: moments when gradual change leads to rapid transformation. For instance, we can examine the percentage of public support required to catalyze societal change or see costs reach a certain threshold. However, the exact percentage, or the overstory that leads to tipping points, can vary dramatically across historic examples and academic research. So, we need a combination of quantitative and qualitative approaches for scenario assessments and transition planning.

You will likely never predict tipping points, but you do know what the new sustainable system must look like. Actively participate in how that change happens.

How do we define what the critical mass will be for sustainability? How do we build and convene it? How do individuals, teams, and entire organizations plan?

Transition plans are often linear. But they must include flexibility as ‘living strategies’ to track how systems are changing and actively strive to prove that the new one works in close collaboration with those in the system who share that ambition. Those pulled unwillingly into alignment with sustainable systems change will not be rewarded or find it a pleasant—or economically positive—experience.

Table 1. Outlining past and future system changes moving us closer to sustainability

| System | Tipping point |

| Renewable energy | A sharp drop in solar and wind costs in the 2010s shifted investment logic, showing the power of economic inflection points to realign global energy systems. Price parity triggered capital flow, and systems began tilting, though not quickly enough yet! NextEra Energy pivoted decades ago toward solar and wind dominance and now has a public transition plan. |

| Leaded petrol | Years of coordinated international pressure, led by the UN, eventually created unified global change. Public health and environmental narratives aligned. Sweden banned leaded petrol in 1995, well ahead of global efforts. |

| CFCs and the Ozone layer | The Montreal Protocol marked rapid science, policy, and international convergence. A clearly defined problem with a proven solution enabled rapid, global systems change. DuPont was one example that committed to phasing out CFCs before formal regulation. |

| MeToo | A landmark case shattered the cultural silence and led to changes in governance, media, and corporate behavior. A critical threshold of exposure and accountability was reached, although progress remains inadequate like so many of these examples. Although this is a response example, not a proactive move, Netflix enhanced on-set safety by introducing anonymous hotlines and mandatory HR briefings, illustrating a broader industry shift. Sadly, this came too late for so many. |

| Economic policy | The 2008 crisis was a negative tipping point that transformed global financial regulation. Market failure forced systemic recalibration across risk, governance, and public trust. Again, not enough. JP Morgan, while not blameless, did advocate tighter financial regulation post-2008, ahead of Basel III mandates. |

| DEI | The horrific, widely witnessed murder of George Floyd and so many others, including Breonna Taylor, led to countless corporate DEI strategies and commitments. While progress remains sub-par and public-facing rhetoric goes through waves, many firms have internalized the moral case, social and reputational risks of inaction, and direct business benefits of diversity. Salesforce invested early in equitable pay and built internal DEI governance. |

| Decarbonization | A mix of public pressure, evolving regulation, and market momentum means that, like DEI, the underlying direction of sustainability remains positive, though not enough, and is subject to waves of outward narratives of different volumes. For example, climate mandates, youth activism, and sector peer pressure are pushing transition planning from voluntary to required. IKEA is one example of several that set science-based targets and has disclosed its transition plan before the majority. |

| Marriage equality | Public support crossing the 50% threshold helped trigger legal system change in the US, culminating in the 2015 Supreme Court decision. After decades of campaigning, and at a point where many thought the cause lost, social consensus proved to be the catalyst for regulatory and institutional realignment. Ben & Jerry’s supported marriage equality early, aligning brand and activism. |

| Civil rights | Sustained public pressure, mobilized through activism and cultural shifts, laid the groundwork for major legislative action. System change followed once the civil rights movement reshaped the societal overstory. IBM led early corporate desegregation efforts and supported civil rights advocacy. |

| Women’s suffrage | After decades of organizing and momentum building, public support translated into constitutional reform in the US. Relentless pressure met political opportunity. Western Union employed women telegraphers and supported suffragist hiring initiatives. |

| Sustainable investment | Viral media or political moments could ignite mass divestment from unsustainable sectors like oil and gas, weapons, or tobacco, outpacing policy change. A narrative that resonates emotionally could flip the financial system’s incentives overnight. Triodos Bank has long excluded fossil fuels and weapons from its portfolio. |

| Financial sector transition planning | The sector is quietly advancing transition plans, but without consistent red lines for clients. A tipping point will come when sustainability-aligned finance becomes the default expectation. Legal & General actively publishes climate stress tests and portfolio alignment plans. |

| Electrification | Power grids are incorporating renewables as their economics continue to improve. Once the electrification of society, battery technology economics, and grid modernization outperform financially, legacy models and fossil fuel demand could collapse. The exact rate remains unknowable, although the requirements of sustainability goals are clear. (Recent unsustainable politics aside) Tesla drove mass consumer adoption of electric vehicles and energy storage innovation. BYD could be argued to have taken over that mantle, bringing the cost of an EV closer to the mass market. |

| Agriculture and food | Cultural and health narratives around plant-based diets are converging with climate urgency and animal welfare. As that overstory continues to break through, plant-based diets will reshape food systems and supply chains. Could it be a specific percentage of a population shunning animal products? Beyond Meat mainstreamed plant-based protein as a climate-conscious food category. |

| Transition planning regulation | A growing number of firms are disclosing transition plans, with regulators in some countries making them mandatory. Once a critical mass is reached—and the economic benefits proven—others will follow, and those transition plans will cascade throughout supply chains and wider systems. Unilever disclosed transition plans before mandates, influencing supply chain norms. |

| Sustainable business value | Responsible business continues to be a differentiator, whether in public or in private. A tipping point will come when leaders realize that doing good is also the most resilient, value-creating strategy. Patagonia embedded planetary stewardship and activism into its business model. |

| Media | Entertainment and digital platforms may face reputational risk for portraying unsustainable lifestyles. When sustainability becomes aspirational content, soft power can hardwire new societal norms. The BBC has committed to sustainable production standards and on-screen climate literacy. Netflix’s satirical movie Don’t Look Up is another powerful example, as is the BBC’s Blue Planet. |

| Technology | Digital traceability or AI-enabled audits, for example, could become the new procurement standard. ‘Radical’ levels of transparency by enough firms could inspire systems-level compliance and accountability. SAP integrated carbon accounting into enterprise software for transparent supply chains. |

| Circular materials | The scarcity of sustainable materials—for instance, locally sourced, recycled, upcycled—or materials for sustainability, such as battery critical metals, could lead to a tipping point advantage for the companies that get ahead and embed circular principles in their value chains. |

Chart 1. The HFS Sustainability Framework breaks down the global context, overcoming barriers, finding spheres of influence, and leading systemic change

Leave a comment