As a senior leader in the energy and utilities industry (E&U), you understand the sector, your firm, your team, and you know that all have to transition. But you’re also in a system that doesn’t allow these transitions to happen—certainly not at the speed required and not when it comes to the energy transition and sustainability more broadly.

While the adoption of AI and emerging technology in E&U is catching up (even outpacing other sectors), the industry still struggles with talent due to a valid perception that it’s neither sustainable nor high-tech.

The relentless drive for efficiency above all else (which both helps and hinders energy transition and AI) must be brought alongside the transition plans that intersect sustainability, technology, and talent.

Alongside those transitions, throw in the restrictive industry dynamics that challenge both short-term optimization and longer-term innovation: restructurings, layoffs, and geopolitical turbulence are pushing E&U firms to relentlessly optimize.

Exxon Mobil and Chevron are two examples of the uncertainty facing E&U employees, as they plan to cut 4% and up to a whopping 20% of their staff, respectively. Neither firm is well thought of for their vision of a sustainable energy transition, or their past attitudes to climate science and investment in clean energy.

The E&U sector’s overwhelming push for efficiency cuts across the explorers, generators, distributors, refiners, marketers, and industries connected with E&U

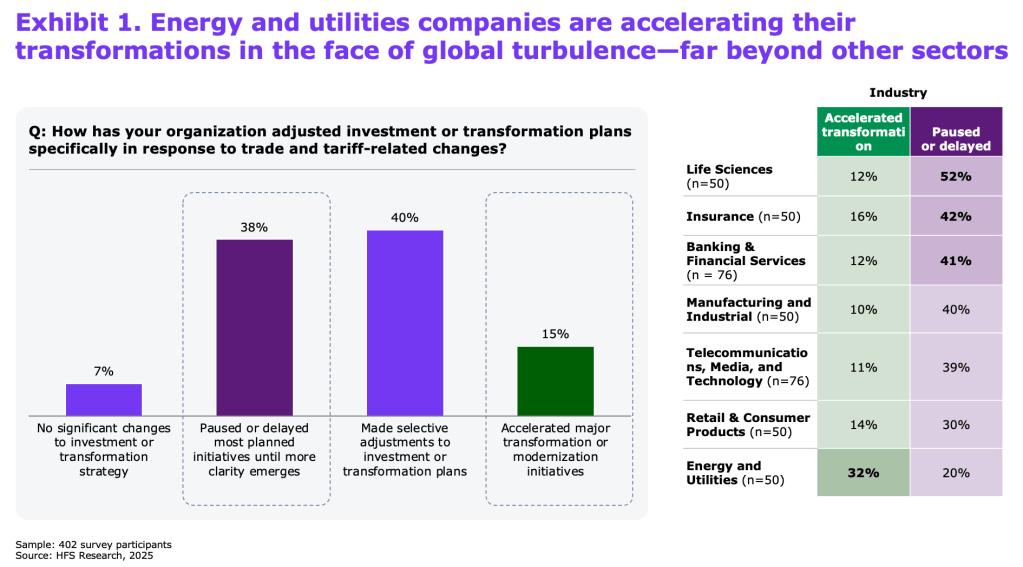

Despite an optimization focus, the innovation teams in E&U enterprises are often siloed, working across different time horizons and disconnected from the business strategy. Nevertheless, E&U investments in transformation are accelerating in the face of global turbulence, while other industries remain cautious (see chart 1).

With efficiency as a priority, the industry is better positioned than it has been historically to align the emerging technology toolbox more clearly with its goals, instead of just adopting tech for innovation’s sake.

But for some, that immediate shareholder pressure is paralyzing for sustainability

The head of sustainability for an international utility recently lamented the state of the firm and the industry’s transition plans. They acknowledge that in many future scenarios compatible with sustainability—especially decarbonization/net-zero—the company would not exist, certainly not in its current form.

The same applies to the oil and gas sector. Recently, when discussing the sector’s transition planning with the head of a large consulting and business services company’s energy practice, oil and gas’s transition planning was illustrated as, essentially, ‘bets’—on technologies that would either replace or allow the current industry to continue operating, like fusion, hydrogen, or carbon capture… or the hope that sufficient capital would exist to buy up renewable energy capacity when needed.

E&U enterprise are taking steps toward joining the now and the future

NextEra, for instance, began its energy transition journey by exploring alternative fuels over 45 years ago. It is now one of the world’s largest renewable energy producers, recently beating profit expectations on surging electricity demand (much of it AI/data center-driven) with a clean energy unit adding 3.2GW. Strategy and investor guidance center on scaling renewables plus storage to serve structural demand growth.

Another example is RWE that has migrated key trading/analytics systems to AWS, citing performance gains and better forecasting. Multi-year power-purchase agreements (PPAs) and the collaboration with AWS, including in RWE’s AI Lab, are aiming to scale renewables and upgrade digital capabilities in response to the rising power demand from data centers.

There’s also the UK’s National Grid, one of the many energy organizations calling for cross-sector transition planning. It uses autonomous drones and AI/satellite vegetation tools to create near real-time asset reports and target work where it’s needed, cutting inspection costs and outages. Its £60 ($82) billion five-year investment plan through 2028/29 with 81% of 2024/25 capex classed as ‘green’ is building capacity for EVs, heat pumps, and renewables, while keeping earnings growth guided at 6–8% CAGR.

Iberdrola is undertaking a €290 ($343) million digitalization push in 2025 to improve operational excellence, customer experience, and cybersecurity across networks and generation. A 2024–2026 strategic plan is committing €41 ($49) billion to grids and clean generation, with digital as the enabler for scale and efficiency.

Transition planning must connect E&U’s time horizons

The Science-Based Targets Initiative (SBTi) has recently produced a new draft standard for power companies, which the whole E&U sector should take on board. It calls for companies to “publicly disclose [transition plans] from unabated fossil fuel power generation,” including “interim actions to decarbonize, phase-out, or retrofit unabated fossil fuel assets, with maximum five-years milestones up to the net-zero year.” They must also stop investing in new ‘unabated’ fossil fuel capacity.

The oil and gas industry, however, has concluded that clean energy investments won’t deliver the same margins as new fossil fuels. This stands in contrast to globally clean energy investments, projected as double the investment going into fossil fuels at $2.2 trillion vs $1.1 trillion, says the IEA, in 2025.

In the steel industry, the largest firms are ramping up production, largely driven by coal, while maintaining net-zero targets. This is increasingly incompatible with the trajectory of the energy transition, locking in capital to fossil energy.

In another example, the increasing demand for air travel remains misaligned with the need to develop cost-competitive sustainable aviation fuel (SAF) or electric flight.

Despite the ongoing turbulence, regulation is moving toward mandated transition planning. Enterprises can leverage the data and analytics used for current ESG reporting levels to build these plans.

At the very least, ESG data can (and often must in law) build materiality assessment to bridge short-term value and long-term strategic advantage. Transition plans can also improve financial sector relationships, fitting into the existing plans of banks, insurers, and all financial services firms.

Financial organizations might not be publicly disclosing transition plans, but they have them. Client collaborations are currently ‘soft’ as one insider put it; but with the long-term mandate of finance versus most sectors, those will turn into red lines.

The Bottom Line: Connecting optimization with three generational transitions—energy, AI, and talent—across time horizons is THE major opportunity for E&U companies to pull ahead.

If there was ever a time to differentiate based on responsible and resilient business, it’s now. The E&U industry is moving faster than many when it comes to AI and other digital technology, despite global uncertainty. Leaders throughout the sector must align this transformation push with the long-term transition plans using the necessary technology, business models, and talent to get there.

There’s still time for individual leaders, teams, or whole organizations to get ahead of these transitions in E&U. To be the ones policymakers, consumers, and other businesses look to as examples of the energy and utilities systems of the future.

Leave a comment