If there was ever a time for sustainability to be more than compliance, it’s now. To be a value, a process, and a reality. We’re hitting irreversible tipping points across climate and nature. So many suffer in totally preventable nightmares, either in conflict or in the supply chains that give us our products and services. The world needs positive tipping points. That’s the call for 2026. To any leader in any industry who wants to maximize their positive impact.

To do so, find your critical mass. In your sphere of influence, prove that a more sustainable future works unequivocally well for the environment, for people, and for business. That proof will help pull along the rest of your team, organization, and industry, as well as policymakers and consumers… stakeholders that will look to you, not your peers, as the benchmark and leader into that sustainable future.

This piece holds four examples of that critical mass that all business leaders can draw from. The examples illustrate opportunities through product/brand teams, finance and energy teams working in combination, technology teams, and CEOs and boards working throughout their organizations to embed sustainability and find their chance at being a part of the systems change we need.

Find what you can make work so well, either yourself, through your team, or across your organization

COP30, the 2025 UN climate summit, highlighted that with sustainability action and narrative being voluntary, you’ll either be a part of the critical mass or be dragged along by it when systems change.

Progress is being made. But we’re losing the systemic battle. We’re not moving through the innovation curve: from innovators, to early adopters, to the early majority (then through to the late majority and laggards) to build a critical mass fat enough. The reinforcing feedback is not yet strong enough for technology, society, or economics.

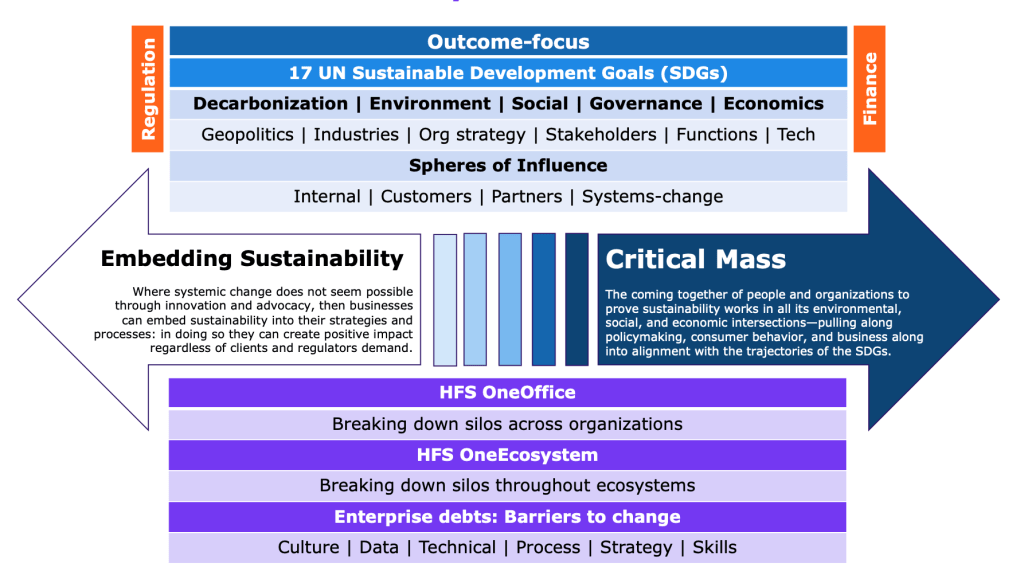

We’ve spoken a lot about transition planning this year and how to find your sphere of influence on sustainability, whether you’re an individual, team, or whole organization (See graphic). Within that lies the chance to be a trigger of positive systems change.

Source: HFS Research

Products and brands can create responsible, resilient supply chains that build a critical mass to force whole industries to do better

50 million people, including 12.5 million children, are in forms of slavery worldwide.

Critical minerals are still sourced from the most shameful labor practices imaginable that include human trafficking, forced labor, debt bondage, and through incredibly dangerous conditions for physical and mental health.

Workers in highly polluted mine air face regular risks of losing limb or life in collapses or dangerous machinery for a few dollars per day. Even if it’s not formal slavery, that anyone would have to work in these conditions, especially for so little, outlines a broken system.

Meanwhile, Elon Musk has had a trillion-dollar wage packet approved.

So, can you find a new customer pool and brand image built around responsible supply chains?

Suppose you’re in charge of a product or brand. In that case, you can use Tony’s chocolate as an example. Specifically, how it called out larger established chocolate firms like Mondelez, Nestle, and more, who have supply chains littered with human rights abuses. Not intentionally. But because the chocolate supply chain is inherently un-transparent. Within that black box, it’s horrifying.

Tony’s also had that supply chain. The whole chocolate industry did/does. Tony’s got its supply chain audited. It found slavery. But that exposed the certain scale of the abuse in the supply chains of the largest firms. Tony’s now has a powerful brand image based around fair wages and working conditions, and gets more publicity every time a bigger firm tries to take it to court.

Finance a critical mass

Clean energy is already building a critical mass. Finance needs to pair with energy and procurement teams. As well as R&D in the right spaces.

Politicians have also trapped themselves into monstrous subsidies for fossil fuels. $1 trillion in direct global subsidy. $7 trillion when accounting for the broader systemic costs like public health. But globally $2.2 trillion is going into clean energy in 2025. Twice the $1.1 trillion is going into fossil energy. Solar and wind costs continue to fall. And despite massive grid and storage investment still required, the energy transition globally is accelerating.

But parts of the world and various sectors are still not getting the funding they need to transition and adapt.

Many businesses still struggle to get the inward investment from their stakeholders or from their CFOs. Even those at the helm of leading sustainable businesses need to keep sharpening their cases. But it goes beyond that.

As a finance leader, can you make the case for something currently struggling for funding? An energy transition project in a new country? Efficiency technology in your processes? Infrastructure such as public transport, preventive health investment, or education? Or a programme to bring your suppliers and customers together around shared sustainability goals?

Africa Investor is one example organization trying to do just that, who we joined at COP28 in Dubai. It aims to bridge the private capital gap to energy transition and smart, sustainable city projects, which have the technical and economic cases ready to go. The Inter-American Development Bank (IDB) is another example, focused on Latin America and the Caribbean.

Much of the energy sector is also calling for transition planning across industries, given they all connect to energy.

Integrated transition planning is the route to much of this working in the short and long term… but let’s first turn to AI.

AI still needs to find its best sphere of influence

AI is a huge headache for the area hosting a datacenter, whether it’s the energy or water demand. And the supply chain conditions for components are nowhere near acceptable. But for the majority of people in organizations, AI holds a positive sphere of influence.

At 2-3% of global emissions, the whole technology sector including chip and electronics manufacturing, is far smaller than some like steel and cement. AI is a fraction of those emissions. It will grow, and rightly technology companies must address its direct impact through efficiency and procuring renewable energy.

But more business leaders should focus on its potential for efficiency, new ideas, new processes, and beyond. See here for more examples.

In the same way that most countries can’t compete with the scale of the US or China on AI… but can be leaders in what you do with AI and the positive outcomes you achieve for society… businesses must find that positive sphere of influence before less positive outcomes come to dominate the story and regulation.

Speaking of regulation and the outcomes it hopes to achieve…

Wasted regulation, deliberate data ‘paralysis’, and integrated transition planning

Despite rollbacks, sustainability-based regulation is still affecting the largest companies that dictate how industries and systems function. On every continent, in different forms: from transition planning, to supply chains, to greenwashing lawsuits.

Many forget that despite the current air of global turbulence that large enterprises are collecting vast amounts of data on sustainability. But that data is too often confined to reporting alone. With teams outside ESG functions barely aware of the richness that exists.

And too many, in bad faith, try to cite the “lack of data” as a means to delay action. The Oil and gas industry is great at this. Don’t fall for it. Data will never be perfect. But you have everything you need.

Seek out your reporting teams if you’re not part of them. They’ve done the materiality assessments. They have the information to find the potential positive impact. A critical mass you may be able to build. Those teams also know what’s not material. What might sound good but not lead to the scale of impact we need, whether that’s the number of trees planted or the tonnes of emissions avoided.

The integrated transition plans that define the leaders in sustainability need collaboration between the CEO, CFO, board, and the sustainability team… with that richness brought to the whole company in strategy and daily operations. Connecting short-term value with long-term sustainability.

History doesn’t look kindly on followers. Neither do regulators, businesses, or your customers

There’s been a lot of talk recently about the 1.5-degree Paris Agreement target being dead. Pathways have been put forward suggesting 1.7 degrees of warming could then be brought back under 1.5 with carbon removal in the best-case scenario. But every fraction of a degree always mattered. Even before we hit 1.5 so many have been impacted, with potential negative tipping points.

Our job has always been to limit the impact to as few people as possible, before stabilizing, and then allowing the environment to thrive… and people thriving with it.

The extra fractions of degrees we hit from now on will only bring further impact as well as the threat of tipping points. Corals dying, ocean currents permanently shifting, and arctic permafrost releasing uncontrollable amounts of planet-warming methane—tipping points which some think we may have hit already.

We’ll see more tipping points over the coming years. Negative and positive.

If you’re not in the positive critical mass for sustainability, you’ll forever be seen as a follower who was forced reluctantly to do the right thing. Find yours in 2026.

Leave a comment